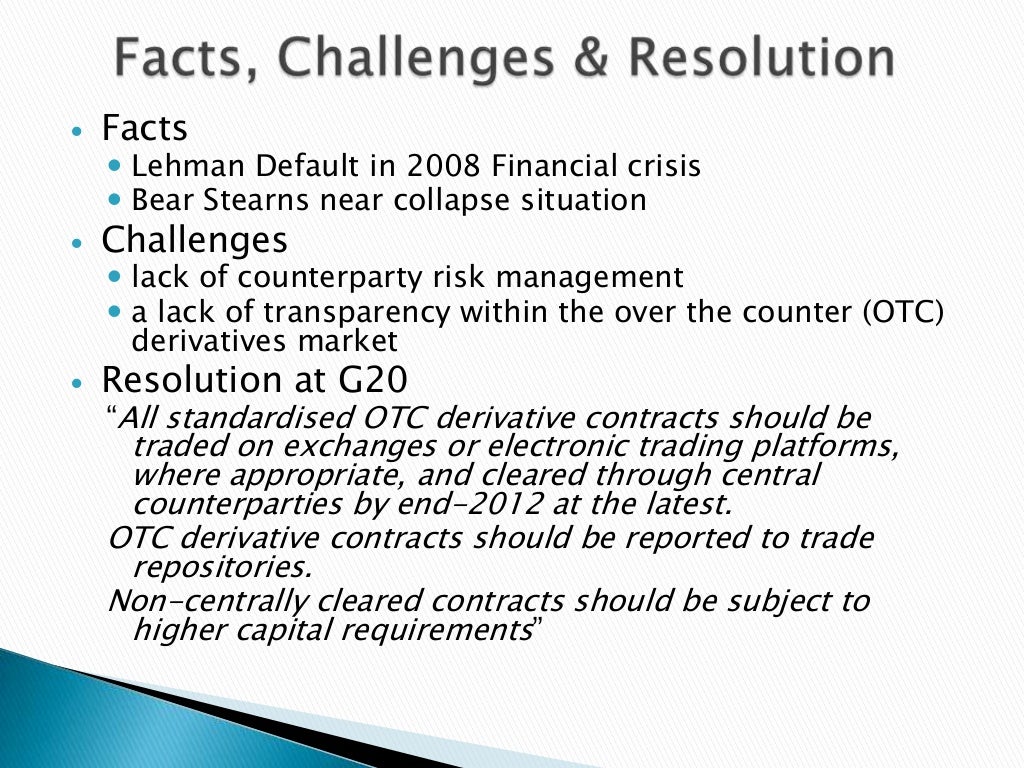

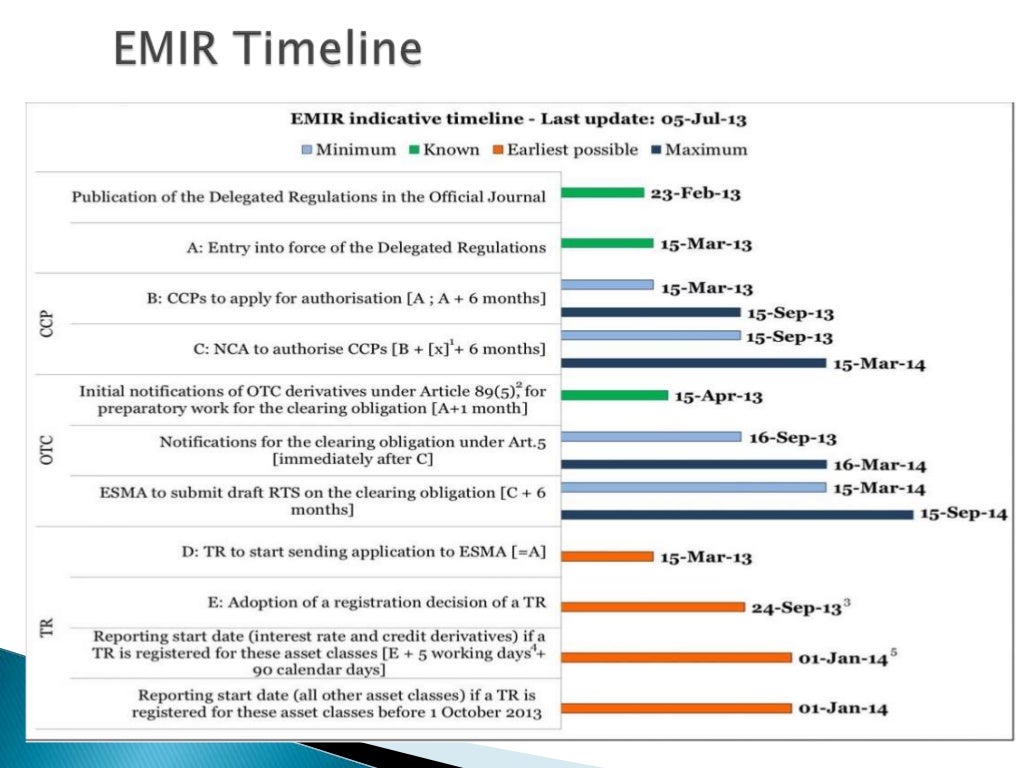

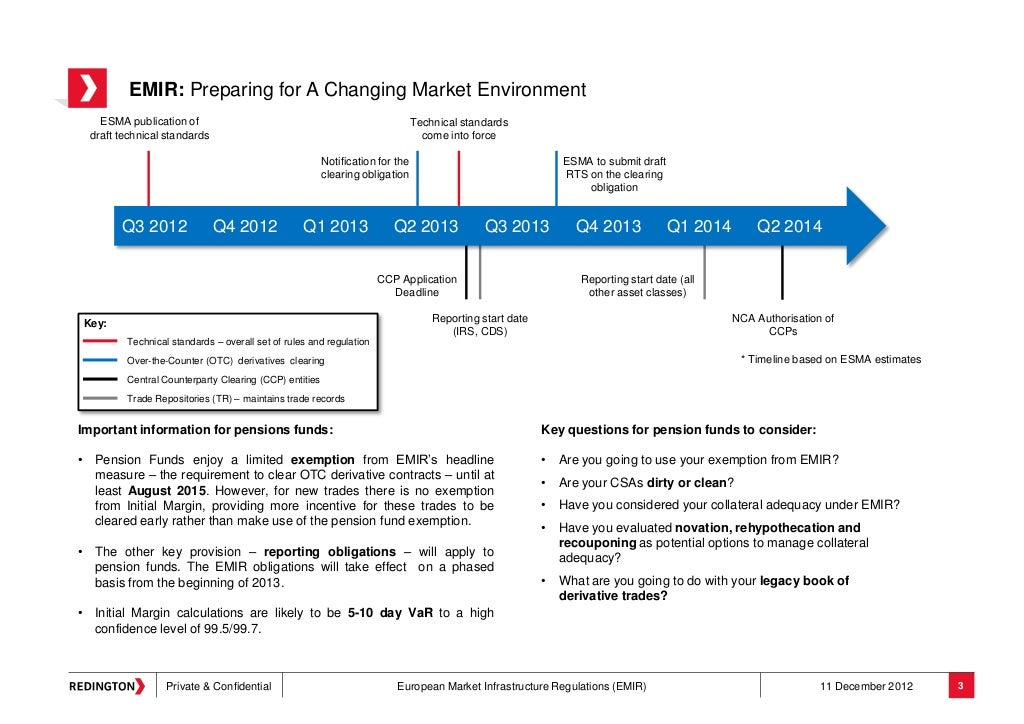

On February 2 2024, the European Securities and Markets Authority (ESMA) updated its Q&As on European Market Infrastructure Regulation (EMIR). On February 7 2024, the Council of the European Union (EU) and the European Parliament reached a provisional agreement on the review of EMIR 3.0.. EMIR introduces reporting requirements to make derivatives markets more transparent. Under the regulation. detailed information on each derivative contract has to be reported to trade repositories and made available to supervisory authorities. trade repositories have to publish aggregate positions by class of derivatives, for both OTC and.

Règlement européen EMIR focus sur les nouvelles dispositions

S&Ds request to quickly approve European market infrastructure regulation (EMIR) Socialists

(PDF) Guide to the European Market Infrastructure Regulation (EMIR) DOKUMEN.TIPS

European Market Infrastructure Regulation PDF

European market infrastructure regulation (emir) Quick Overview

PPT Derivatives Emir Regulation Reg. n. 648/2012, PowerPoint Presentation ID4083011

European Market Infrastructure Regulation (EMIR) New EU Rules on De…

Overview of EMIR Regulation

European Market Infrastructure Regulation (EMIR) Refit Virtusa

Etude EMIR (European Market Infrastructure Regulation)

EMIR European Market Infrastructures Regulation

‘EMIR ¿ European Market Infrastructure Regulation Auswirkungen der Neuerungen für nicht

European Market Infrastructure Regulation (EMIR) • Definition Gabler Banklexikon

European Market Infrastructure Regulation (EMIR) Now Available on Ascent

European market infrastructure regulation (emir) Quick Overview

European Market Infrastructure Regulations (EMIR) An Introduction

(PDF) European Market Infrastructure Regulation (EMIR) · • EMIR protects collateral placed with

Etude EMIR (European Market Infrastructure Regulation)

European Market Infrastructure Regulation (EMIR) Overview EIMF Academy

European market infrastructure regulation (emir) Quick Overview

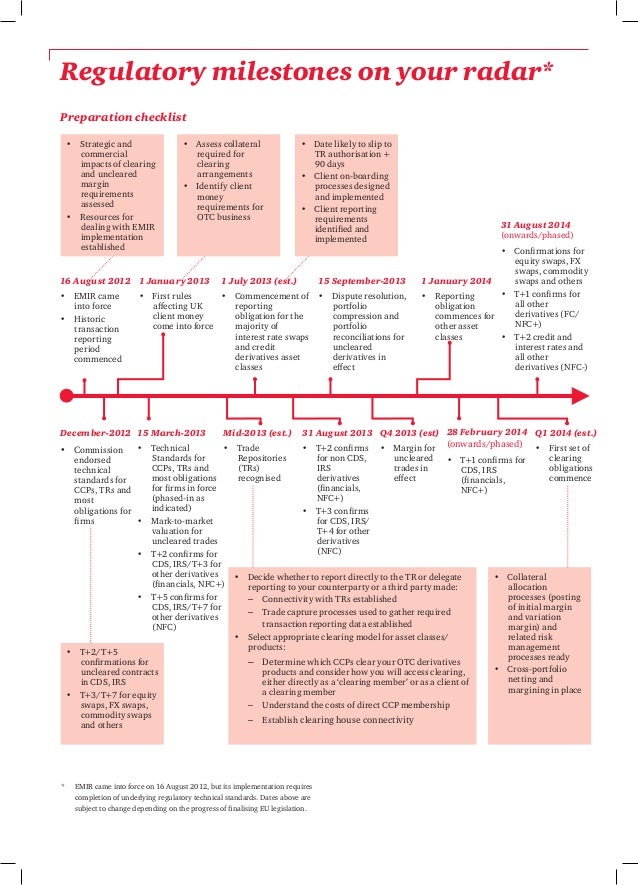

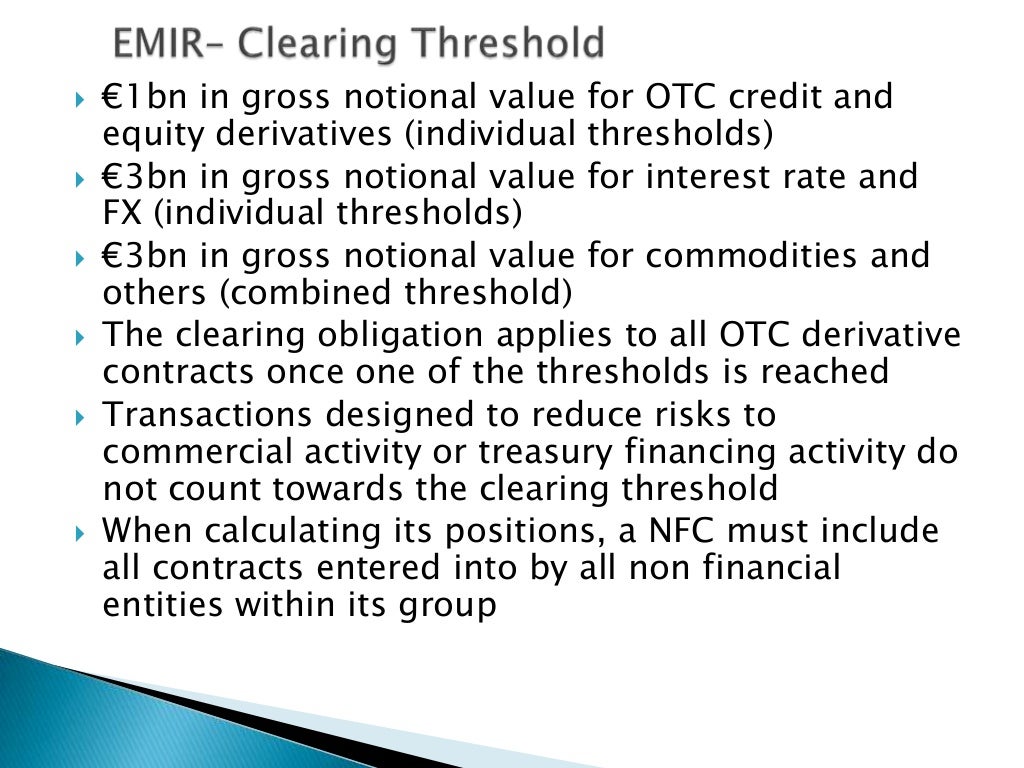

European Market Infrastructure Regulation (EMIR) Overview. Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories entered in force on 16 August 2012. The most important aim of the European Markets Infrastructure Regulation (EMIR) is to increase the transparency of the over the counter (OTC.. The European market infrastructure regulation (EMIR) lays down rules regarding over-the-counter (OTC) derivative * contracts, central counterparties (CCPs) * and trade repositories *, in line with the G20 commitments made in Pittsburgh, United States, in September 2009.