Step2: Estimate the cost. Next, a very important point is the valuation of the property. For example, if the property is worth $ 400,000, then, in this case, your partner is entitled to half of this amount, that is, $ 200,000. This means that you need to find $200,000 to redeem her or him. You should get an accurate estimate of the value of the.. This FMV report would give a price or price range that your son’s ex could take to the bank in order to obtain mortgage financing. She would then be responsible for paying your son half of the.

How to Add Someone to Your Mortgage 12 Steps (with Pictures)

Premium Vector Mortgage concept for web banner man takes out mortgage online signs contract

How to Calculate Buying Someone Out of a House Orchard

How to Calculate Buying Someone Out of a House

Mortgage Rates, Still Historically Low, Begin Ricking Upward Inman

5 Reasons You Should Use a Mortgage Broker in 2020 Mortgage humor, Mortgage brokers, Mortgage

Need a Mortgage? Why and How You Should Shop Around Home Buying Resources ABR

What to Know Before Getting Your First Mortgage

Still Renting? Why pay someone else’s mortgage? How’s that roommate situation working for ya

How to Add Someone to Your Mortgage 12 Steps (with Pictures)

The Mortgage Process Doesn’t Have To Be Scary! Here are some EASY STEPS to help you 🏠

Taking Out a Mortgage 4 Things You Shouldn’t Do.

Expert Guide Removing Someone from a Mortgage YesCanDo Money

Man and Women Taking Out Mortgage, Collecting Money for Family Budget. Stock Vector

CashOut Mortgage Refinancing Basics and Qualities, Part 1 PRMI Shoreline

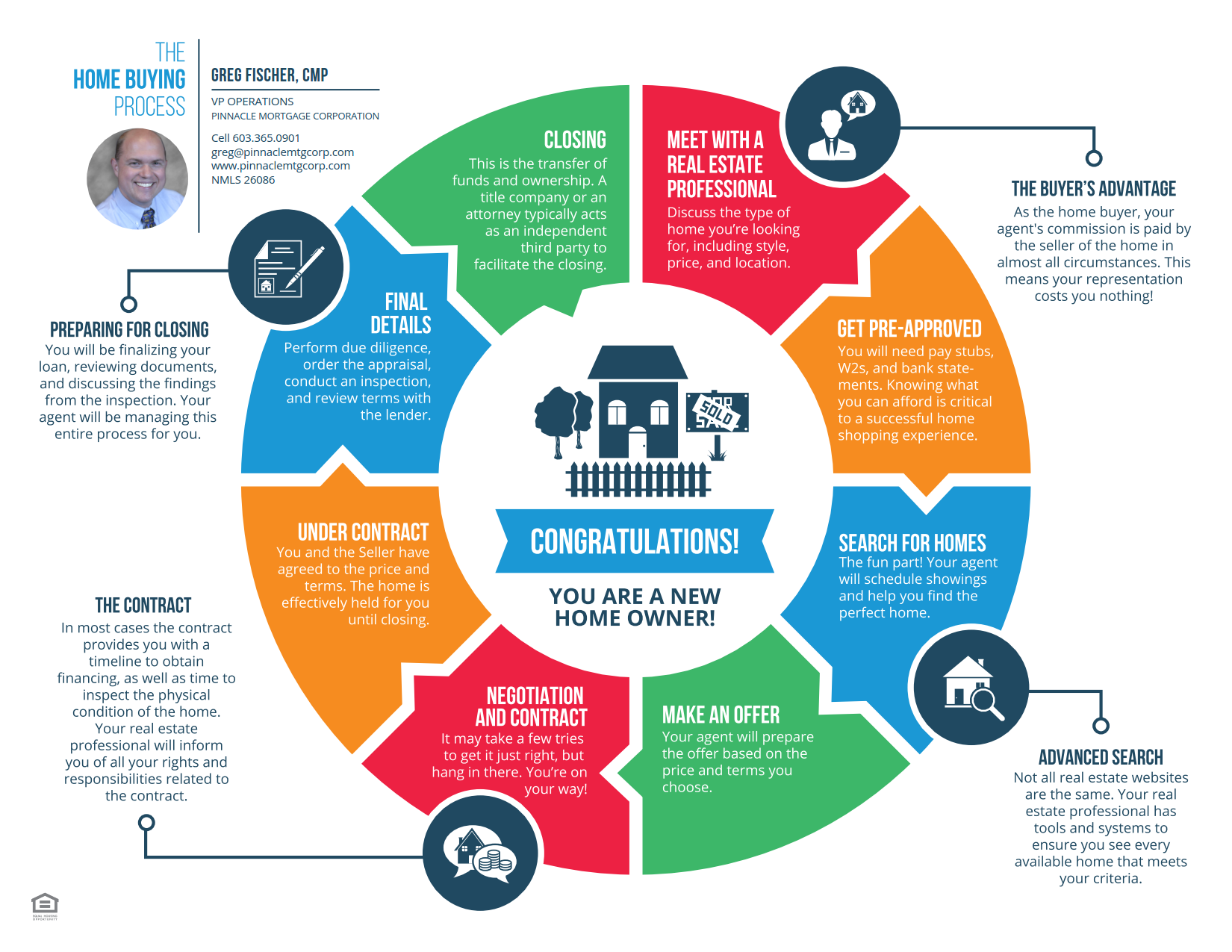

The Home Buying Cycle Pinnacle Mortgage Corp

How To Buy Someone Out Of a House Mortgage Your Equity

Is A Cash Out Mortgage Refinance Right For You Refinancing With Low Interest Home Loan YouTube

How to Add Someone to Your Mortgage 12 Steps (with Pictures)

Someone outside of the Mortgage Industry and looking to make a move to a Mortgage Agent

Equity for each spouse. $100,000. To determine how much you must pay to buy out the house, add your ex’s equity to the amount you still owe on your mortgage. Using the same example, you’d need to pay $300,000 ($200,000 remaining mortgage balance + $100,000 ex-spouse equity) to buy out your ex’s equity and become the house’s sole owner.. The essential steps to buy someone out of a house include calculating the equity, agreeing on the buyout amount, obtaining consent from the mortgage lender, and securing financing to complete the transfer of equity. Each situation may have unique considerations, so seeking legal or financial advice is advisable for a smooth process.